Climate Strategy

The climate strategy is part of Swiss Life’s sustainability strategy and the new Group-wide programme “Swiss Life 2024”. The sustainability strategy is oriented towards four fields of action: own business behaviour, the role as an asset owner and manager, the insurance and advisory business, and the role of employer. The first three areas are particularly relevant for Swiss Life’s climate strategy. In addition, Swiss Life is involved in dedicated networks and associations. For its sustainability and climate goals, Swiss Life prioritises those areas in which the company can have a direct impact.

Swiss Life recognises that climate change, if left unmitigated, will have negative effects on society and the global economy. Swiss Life is committed to playing an active role in contributing to the transition to a low-carbon and climate-resilient economy in line with the Paris Climate Agreement. Furthermore, Swiss Life expects further increases in transparency requirements from stakeholders (e.g. customers, regulators, supervisory authorities, investors and employees) regarding products and services and an increasing demand for sustainable products. Moreover, Swiss Life’s investments in securities, real estate and infrastructure could be affected by the physical impacts of climate change and the transition to a low-carbon and climate-resilient economy.

Swiss Life is therefore integrating sustainability and climate aspects into its existing risk management standards for the management of its business and is assessing the actual and potential impacts of climate-related risks and opportunities on its business, strategy, and financial planning. Physical risks and opportunities relate to the manifestation of acute alterations in the climate (climate-induced natural disasters, e.g. extreme precipitation or drought) and chronic alterations (gradual climate-related changes, e.g. temperature rise, sea level rise). Transition risks and opportunities relate to impacts associated with the transition to a low-carbon and climate-resilient economy, such as incisive climate policy measures, changed customer preferences or disruptive technological breakthroughs. As climate-related risks are risk drivers for existing risk categories, Swiss Life can build on its existing comprehensive risk management standards for the identification, assessment and appropriate management of climate-related risks and opportunities. Information on Swiss Life’s comprehensive risk management standards is available on in section “Risk Management”. In In section “Metrics and Targets” onwards a selection of supporting metrics can be found.

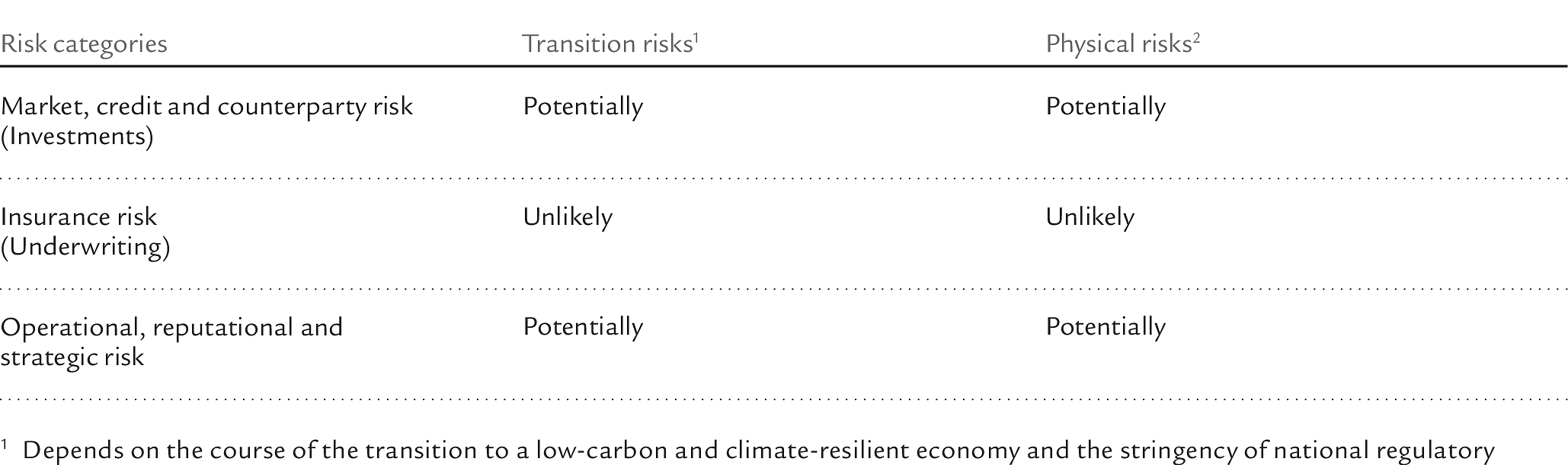

Summary of potential impact of climate-related risks on risk categories of Swiss Life

Depending on the course of the transition to a low-carbon and climate-resilient economy, the effects already arising today of climate change and the measures to mitigate climate change may change in the medium and long term.

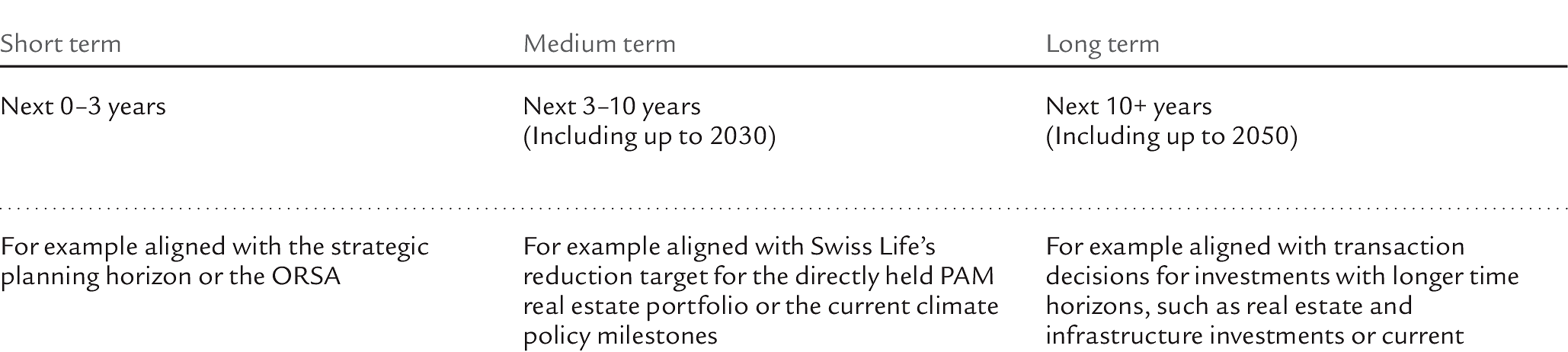

Time horizons for climate-related risks and opportunities of Swiss Life

For internal analyses of climate-related risks and opportunities, Swiss Life currently relies on a definition of the short-term time horizon that goes hand in hand with the strategic planning horizon and the Own Risk and Solvency Assessment (ORSA). These are supplemented by specific medium- and long-term analyses based on the scenarios of the Network for Greening the Financial System (NGFS). The medium-term time horizon is currently aligned with the reduction path for real estate directly owned by Proprietary Insurance Asset Management (PAM) or, more generally, with the current climate policy milestones. The definition of the long-term time horizon goes hand in hand with the transaction decisions for investments with longer time horizons, such as real estate and infrastructure investments, and is geared to current climate policy developments.