Carbon intensity

Climate-related portfolio ambitions of the Swiss Life Group

Paris Climate Agreement

In the context of its PAM portfolio – securities, real estate and infrastructure – Swiss Life’s ambition is to make financial flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development and thus contribute to a central goal of the Paris Climate Agreement.

In addition to other metrics in the context of the PAM securities and real estate portfolios, Swiss Life works with the carbon intensity climate indicator. Carbon intensity is an indicator of greenhouse gas efficiency. For government bonds, the metric reflects greenhouse gas emissions in relation to nominal gross domestic product (GDP) while for corporate bonds and equities it reflects these emissions in relation to sales. For real estate, the metric reflects greenhouse gas emissions in relation to floor area.

In the context of greenhouse gas accounting following the GHG Protocol Corporate Standard, the carbon footprint of Swiss Life’s PAM securities and real estate portfolios corresponds to a subset of Swiss Life’s Scope 3 emissions: these correspond to categories 13 “Downstream leased assets” and 15 “Investments”.

Weighted average carbon intensity of the Swiss Life Group’s PAM securities portfolio1 as at 31 December 2022

| Asset class | Unit | 2022 2 | ||

|---|---|---|---|---|

| Government bonds | t CO2e/USD million GDP nominal | 176 | ||

| Corporate bonds | t CO2e/USD million sales | 133 | ||

| Equities | t CO2e/USD million sales | 146 | ||

|

1 In the context of the TCFD Report, government bonds only comprise bonds issued by nation states. Corporate bonds also include covered bonds as well as bonds issued by state-affiliated companies and supranationals. This deviation from other financial publications is due to the calculation logic underlying the carbon intensity. The slightly refined methodology does not lead to significant changes in the weighted average carbon intensity values.

|

||||

|

2 The weighted average carbon intensity values correspond to more than 90% of the amortised costs of the analysed PAM government bond portfolio, more than 80% of the amortised costs of the analysed PAM corporate bond portfolio and more than 90% of the market value of the analysed PAM equity portfolio of the Swiss Life Group. © 2023 MSCI ESG Research LLC. Reproduced by permission. Data from MSCI ESG Research LLC is as at 31 December 2022.

|

||||

100% of Swiss Life’s PAM government bond portfolio is invested in countries that have ratified the Paris Climate Agreement. The weighted average carbon intensity of Swiss Life’s PAM corporate bond portfolio reflects the strong presence of service-related industry sectors.1 As partially replicating equity index strategies are pursued for the PAM equity portfolio, the weighted average carbon intensity of the PAM equity portfolio is not affected by targeted over- and underweighting based on selected characteristics. Swiss Life’s PAM securities portfolio currently has a lower carbon intensity than relevant benchmarks.

Among other criteria, Swiss Life aims at bond investments in countries and companies with a low overall carbon intensity. As an investor, however, Swiss Life cannot directly control the carbon intensity of the issuers.

1 On average, service-related industry sectors have a lower carbon intensity than other industry sectors.

Swiss Life can directly influence the carbon intensity of the PAM real estate portfolio it holds directly. Real estate is a major contributor to global CO₂ emissions and is at the same time exposed to climate-related risks. As one of Europe’s leading real estate investors and owner of Switzerland’s largest private real estate portfolio, Swiss Life is aware of its responsibility concerning the transition to a low-carbon economy.

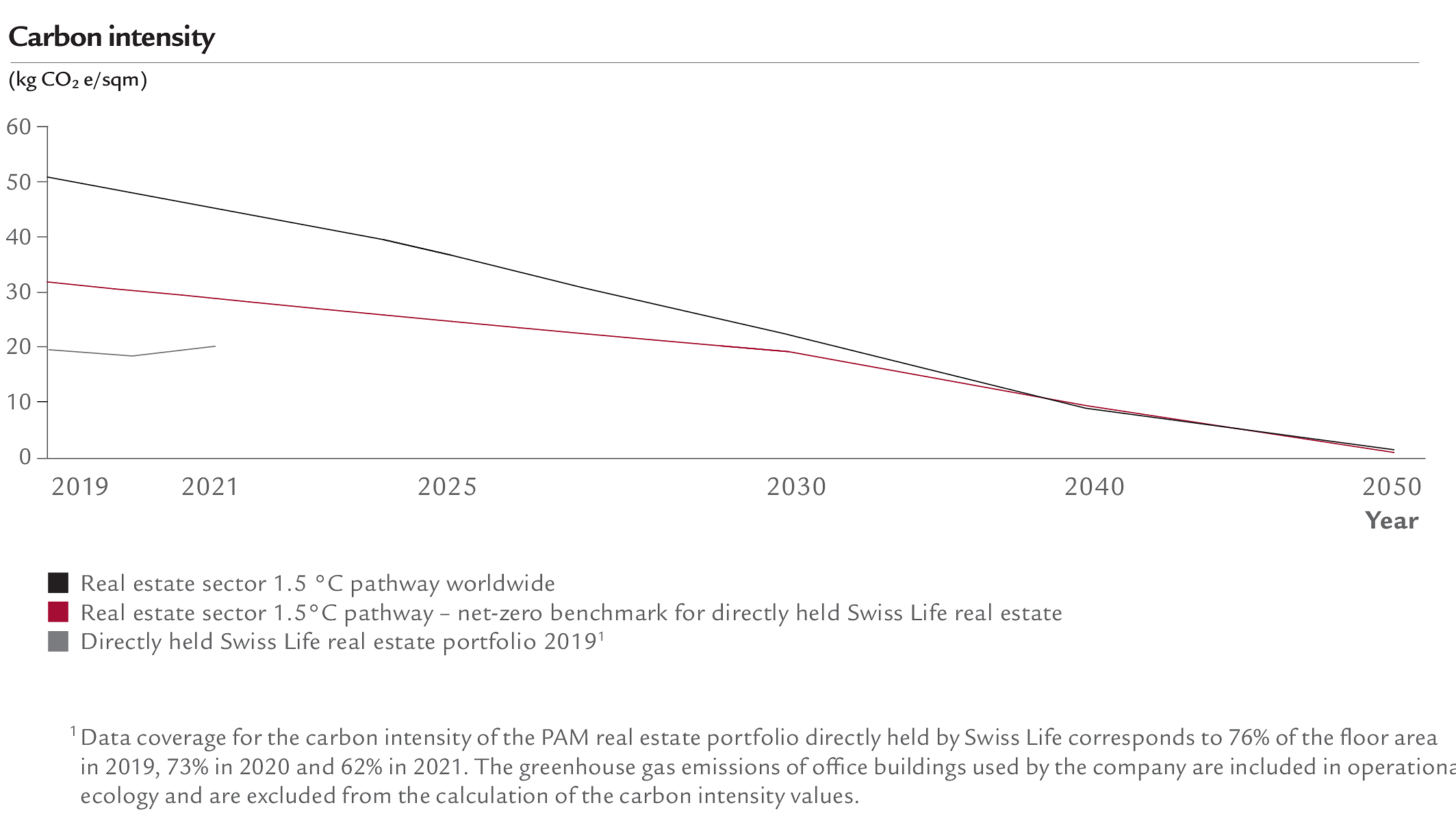

In 2021, Swiss Life established a reduction path for the CO₂ intensity of its directly held PAM real estate portfolio and published an initial CO₂ intensity figure for 2019. During the year under review, Swiss Life continued to drive this goal forward and added another two years (2020 and 2021). The reduction path is based on current best practice (the CRREM¹ calculation method) and is in line with the goals of the Paris Climate Agreement.

Swiss Life has set itself the target of reducing the carbon intensity of its directly held PAM real estate portfolio by 20% by 2030 compared to 2019. A total of around CHF 2 billion will be invested over this period in order to achieve this target. The measures include, among other things, the implementation of energy efficiency and CO₂ efficiency measures and the switch from fossil to non-fossil energy sources. To monitor the achievement of these objectives, Swiss Life has rolled out a specially developed cockpit and integrated this into its existing IT applications. With regards to data and methodology, Swiss Life focuses on improving data quality and coverage and has taken country-specific measures accordingly.

1 The latest published version available during the year 2022 was used.

During the year under review, Swiss Life further developed its methodology for calculating the CO₂ intensity of its directly held PAM real estate portfolio. The CO₂ coefficients have been adapted to the coefficients published by CRREM. Data quality and coverage have been improved for most units. In the Swiss and French markets, missing data was replaced with approximations, taking due account of these countries’ existing national standards/guidelines and the previous year’s consumption figures. Owing to the improved methodology, the data from the previous year’s TCFD Report are restated as follows: The carbon intensity for the 2019 reporting year is reduced from 26 kg CO₂ e/sqm to 20 kg CO₂ e/sqm. For 2020 and 2021, two further data points – 18 kg CO₂ e/sqm (2020) and 20 kg CO₂ e/sqm (2021) – have been added. Due to the data collection process, certain consumption values are only available after a time-lag of up to three years and are continuously updated, which may lead to slight changes in the published carbon intensities.

The 2019 baseline – a carbon intensity of 20 kg CO₂ equivalents per square metre of floor area – is already well below the global net zero path of the real estate sector. This baseline is also below the net-zero scenario benchmark of Swiss Life, which reflects the specific composition of the directly held PAM real estate portfolio of Swiss Life in terms of geography and investment type.