Carbon intensity

With reference to CRREM, greenhouse gas emissions resulting from the operation of properties within Swiss Life Asset Managers’ TPAM real estate portfolio can be classified as emissions controllable by the lessor and emissions controllable by the tenant. In this report, Swiss Life applies the GHG Protocol Corporate Standard. In Swiss Life’s climate reporting, carbon intensity currently covers the total greenhouse gas emissions resulting from the operation of properties.

Weighted average carbon intensity of Swiss Life Asset Managers’ TPAM real estate portfolio1 as at 31.12.2023

| Asset class | Unit | 2023 | ||

|---|---|---|---|---|

| Real estate | kg CO₂e/m2 | 25 | ||

|

1 The calculation of the weighted average carbon intensity of Swiss Life Asset Managers' TPAM real estate portfolio for 2023 is based on consumption values for 67% of the gross floor area. The remaining share of 33% was estimated. Information on consumption and estimates can be found in the appendix.

|

||||

According to greenhouse gas accounting under the GHG Protocol Corporate Standard, greenhouse gas emissions within Swiss Life Asset Managers’ TPAM securities portfolio correspond to a subset of Swiss Life’s Scope 3 emissions and belong to category 15 “Investments”.

Weighted average carbon intensity of Swiss Life Asset Managers’ TPAM government bond, corporate bond and equity portfolio1, 2 as at 31.12.2024 (attributable, as per GHG Protocol Corporate Standard, to Swiss Life’s Scope 3 emissions, category 15 “Investments”)

| Asset class | Unit | 2024 | ||

|---|---|---|---|---|

| Government bonds | t CO₂e/USD million GDP nominal | 209 | ||

| Corporate bonds | t CO₂e/USD million sales | 84 | ||

| Equities | t CO₂e/USD million sales | 80 | ||

|

1 For the purposes of the TCFD Report, government bonds only include bonds issued by nation states. Corporate bonds also include covered bonds and bonds issued by government-related entities or supranationals. This deviation from other financial publications is due to the calculation logic underlying the carbon intensity. Corresponding positions from the fund look-through are taken into account where available. Green, social and sustainable bonds are included in the same way as bonds without specific reference to sustainability aspects.

|

||||

|

2 The coverage of the weighted average carbon intensities correspond to over 90% of the market value of the TPAM government bond portfolio, over 90% of the market value of the TPAM corporate bond portfolio and over 90% of the market value of the TPAM equity portfolio of Swiss Life Asset Managers. © 2024 MSCI ESG Research LLC. Reproduced with permission. The data published by MSCI ESG Research LLC as of 31.12.2024 was used.

|

||||

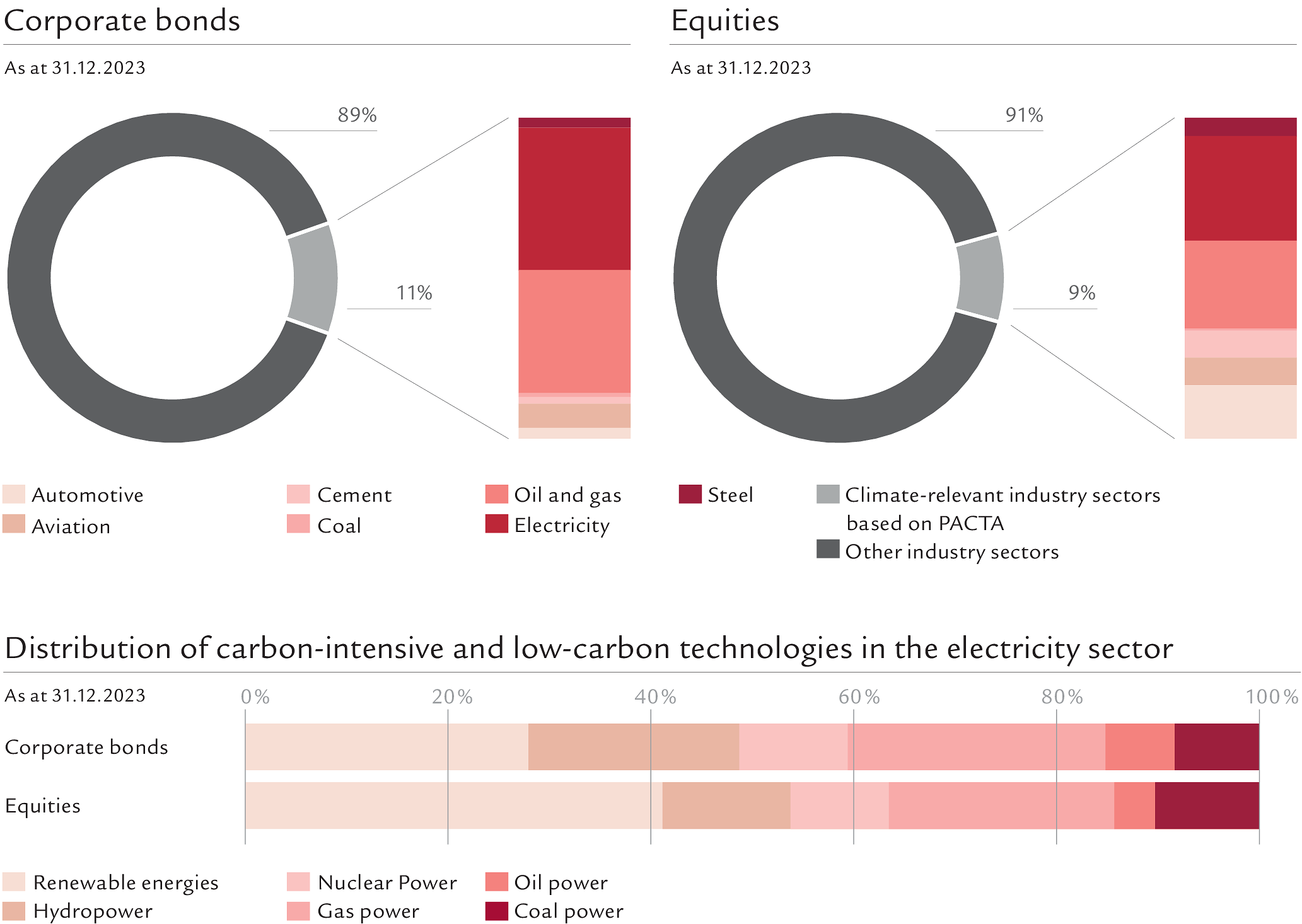

Exposure to climate-relevant industry sectors in Swiss Life Asset Managers’ TPAM corporate bond and equity portfolio based on PACTA