Proprietary Insurance Asset Management Portfolio

Climate-related portfolio ambitions of the Swiss Life Group

Paris Agreement

In the context of its PAM portfolio – securities, real estate and infrastructure – Swiss Life’s ambition is to make financial flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development and thus contribute to a central goal of the Paris Agreement.

In addition to other metrics, Swiss Life works with the climate-related metric carbon intensity. Carbon intensity is an indicator of greenhouse gas efficiency. For real estate, the metric reflects greenhouse gas emissions in relation to gross floor area. For government bonds, this metric reflects greenhouse gas emissions in relation to nominal gross domestic product (GDP) while for corporate bonds and equities it reflects these emissions in relation to sales.

In its directly held PAM real estate portfolio, Swiss Life is able in some cases to directly influence carbon intensity. With reference to Carbon Risk Real Estate Monitor (CRREM), greenhouse gas emissions resulting from the operation of properties within the Swiss Life PAM real estate portfolio held directly for investment purposes can be classified as emissions controllable by the lessor and emissions controllable by the tenant. In this report, Swiss Life applies the GHG Protocol Corporate Standard. In Swiss Life’s climate reporting, carbon intensity currently covers the total greenhouse gas emissions resulting from the operation of properties.

Real estate is a major contributor to global CO₂ emissions and is at the same time exposed to climate-related risks. As one of Europe’s leading real estate investors and the owner of one of Switzerland’s largest private real estate portfolios, Swiss Life is aware of its responsibility concerning the transition to a low-carbon and climate-resilient economy.

Swiss Life has set itself the target of reducing the carbon intensity of its directly held PAM real estate portfolio by 20% by 2030 compared to 2019. Around CHF 2 billion will be invested over this period in order to achieve this target. The measures include, among other things, the implementation of energy efficiency and CO₂ efficiency measures and the switch from fossil to non-fossil energy sources.

The period considered for the current carbon intensity calculation is the calendar year 2023. Due to the data collection process, certain consumption values are only available with a time-lag of as much as three years. Therefore, adjustments to the published carbon intensity figures may be made retroactively. This is reflected in the development of the data coverage.

For 2023, the carbon intensity of Swiss Life’s PAM real estate portfolio held directly for investment purposes comes to 14 kg CO₂e/m2🗸, which corresponds to a decrease of 13% compared to 2019. Based on current analyses of planned capital expenditure, a reduction of approximately 35% can be expected by 2030. The analyses are based on the CRREM status updated in 2023. The setting of the carbon intensity reduction target for Swiss Life’s directly held PAM real estate portfolio is based on the CRREM status at the time.

According to greenhouse gas accounting under the GHG Protocol Corporate Standard, greenhouse gas emissions within Swiss Life’s PAM securities portfolio correspond to a subset of Swiss Life’s Scope 3 emissions and belong to category 15 “Investments”. Swiss Life is already well positioned today in terms of selected metrics relating to the greenhouse gas emissions of the PAM corporate bond portfolio. Swiss Life wishes to maintain this position as part of the “Swiss Life 2027” Group-wide programme.

🗸 PwC CH

Compared to the previous year, the weighted average carbon intensity of Swiss Life’s PAM government bond portfolio has decreased. Most of this reduction can be attributed to changes in the countries’ GDP and greenhouse gas emissions and to changes in the portfolio composition.

Weighted average carbon intensity of the Swiss Life Group’s PAM government bond portfolio1, 2 as at 31.12.2024 (attributable, as per GHG Protocol Corporate Standard, to Swiss Life’s Scope 3 emissions, category 15 “Investments”)🗸

| Asset class | Unit | 2024 | ||

|---|---|---|---|---|

| Government bonds | t CO₂e/USD million GDP nominal | 135 | ||

|

1 For the purposes of the TCFD Report, government bonds only include bonds issued by nation states. Corporate bonds also include covered bonds and bonds issued by government-related entities or supranationals. This deviation from other financial publications is due to the calculation logic underlying the carbon intensity. Green, social and sustainable bonds are included in the same way as bonds without specific reference to sustainability aspects.

|

||||

|

2 The coverage of the weighted average carbon intensity corresponds to over 90% of the amortised costs of the PAM government bond portfolio of the Swiss Life Group. © 2024 MSCI ESG Research LLC. Reproduced with permission. The data published by MSCI ESG Research LLC as of 31.12.2024 was used.

|

||||

The weighted average carbon intensity of Swiss Life’s PAM corporate bond portfolio reflects the strong presence of service-related industry sectors1. The PAM equity portfolio partially replicates equity index strategies. Therefore, the carbon intensity of the PAM equity portfolio can only be controlled to a limited extent through targeted adjustments.

Compared to the previous year, the weighted average carbon intensity based on issuers’ Scope 1 and Scope 2 emissions has decreased. This development can be largely attributed to changes in the companies’ revenues and greenhouse gas emissions as well as to changes in the portfolio composition. The issuers’ Scope 1 and Scope 2 emissions are partly reported by the issuers themselves and partly estimated by the external data provider.

Weighted average carbon intensity of the Swiss Life Group’s PAM corporate bond and equity portfolio1, 2 as at 31.12.2024 (attributable, as per GHG Protocol Corporate Standard, to Swiss Life’s Scope 3 emissions, category 15 “Investments”)🗸

| Asset class | Unit | 2024 | ||

|---|---|---|---|---|

| Corporate bonds | t CO₂e/USD million sales | 82 | ||

| Equities | t CO₂e/USD million sales | 87 | ||

|

1 For the purposes of the TCFD Report, government bonds only include bonds issued by nation states. Corporate bonds also include covered bonds and bonds issued by government-related entities or supranationals. This deviation from other financial publications is due to the calculation logic underlying the carbon intensity. Green, social and sustainable bonds are included in the same way as bonds without specific reference to sustainability aspects.

|

||||

|

2 The coverage of the weighted average carbon intensities correspond to approximately 90% of the amortised costs of the PAM corporate bond portfolio and over 90% of the market value of the PAM equity portfolio of the Swiss Life Group. © 2024 MSCI ESG Research LLC. Reproduced with permission. The data published by MSCI ESG Research LLC as of 31.12.2024 was used.

|

||||

1 On average, service industries have a lower carbon intensity from Scope 1 and Scope 2 emissions than other industry sectors.

🗸 PwC CH

The ratio between the weighted average carbon intensity based on the issuers’ Scope 1 and Scope 2 emissions and the weighted average carbon intensity based on the issuers’ Scope 3 emissions differs according to the industry sector in question. The issuers’ Scope 3 emissions are based on estimates by the external data provider.

Distribution of the companies in which the Swiss Life Group’s PAM securities portfolio1 is invested by industry sector of the weighted average carbon intensity of Scope 1 and Scope 2 emissions relative to Scope 3 emissions, as at 31.12.2024

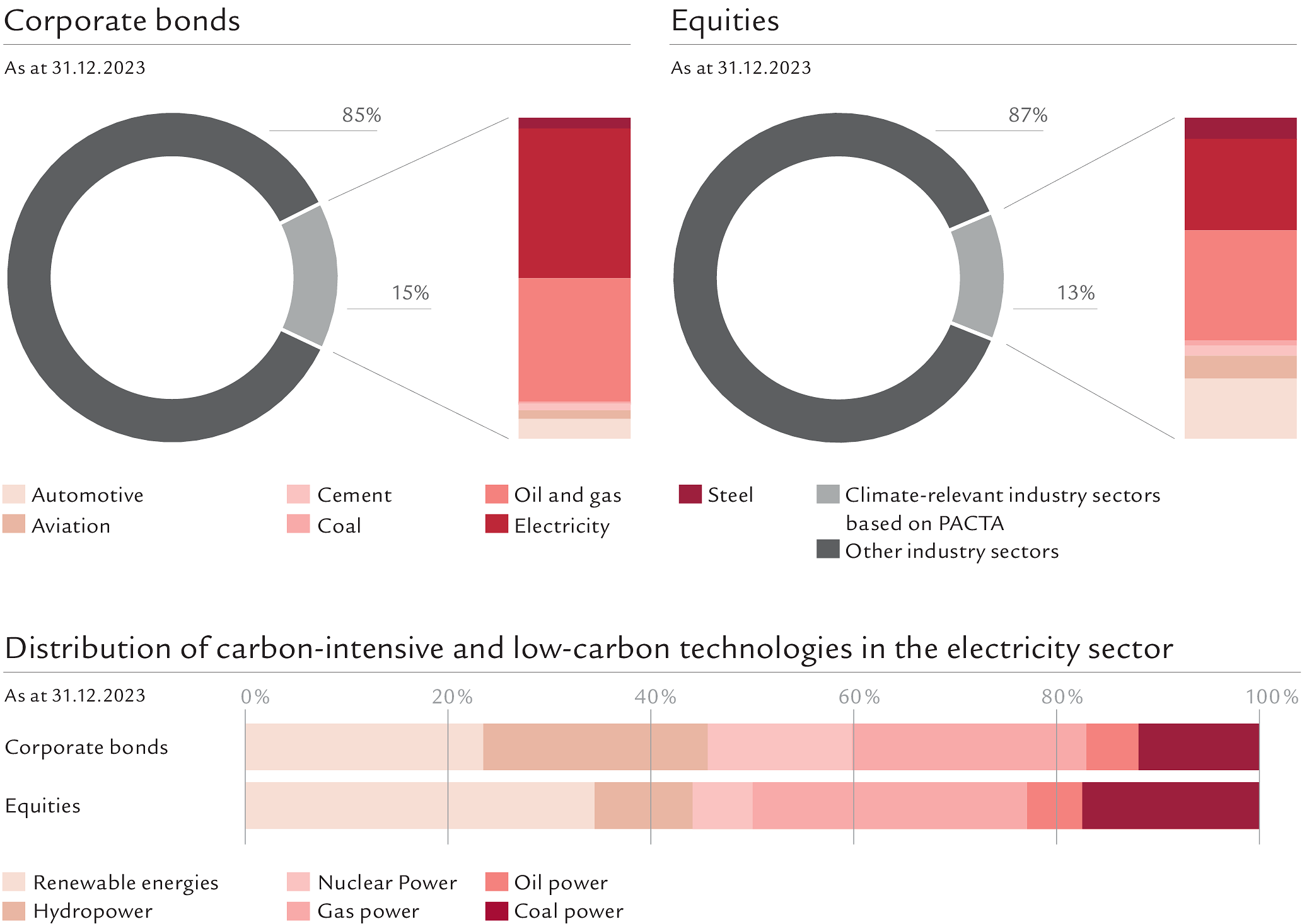

An in-depth understanding of exposure to carbon-intensive and low-carbon technologies in climate-relevant industry sectors can help identify potential challenges related to the transition to a low-carbon economy. Selected results from the Swiss Climate Test 2024, which is based on PACTA, include relevant information. Swiss Life works with further results from the Swiss Climate Test 2024 where possible and appropriate.

Exposure to climate-relevant industry sectors in the Swiss Life Group’s PAM corporate bond and equity portfolio based on PACTA

Climate-related portfolio ambitions of the Swiss Life Group

Thresholds for coal

Swiss Life has adopted a thermal coal phase-out strategy for its PAM corporate bond portfolio, applying the thermal coal threshold set by Swiss Life Asset Managers as part of its responsible investment approach.

In addition, for corresponding investments, Swiss Life applies the coal threshold set by Swiss Life Asset Managers as part of its responsible investment approach for infrastructure equity investments within infrastructure funds.

The limits for coal relate to the areas in which Swiss Life can in principle make corresponding investments.

A thermal coal phase-out strategy for the PAM corporate bond portfolio has been formalised in order to contribute to the transition towards a low-carbon economy and mitigate the risk of stranded assets. In the course of 2020, investments within the PAM securities portfolio in companies that derive 10% or more of their revenues from the mining, extraction or sale of thermal coal to external parties were reduced to 0%. As at the end of 2024, this position remains unchanged at 0%.

In connection with Article 29 of the French regulation “Loi Énergie-Climat”, Swiss Life France has implemented a specific coal phase-out strategy.

In terms of the threshold, investments within the PAM infrastructure equity portfolio remained unchanged at 0% as at the end of 2024.